Markets Brief: Is It Really a Surprising Quarter for Earnings?

Plus: Apple’s outlook and Fed rate cuts on hold.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Winning the Earnings Game

As we enter the last quarter of the US earnings season, the management teams at large companies have again managed to create a positive “surprise” by lowering expectations ahead of their reports. According to FactSet, analysts forecast year-on-year profit growth among large US companies to be 3.4% at the start of the quarter, whereas we are on track to witness actual growth of 5.0%. That seems like a win until you consider that at the end of last year, first-quarter earnings were expected to rise by more than 6%.

This gamesmanship reminds us that short-term results are often a distraction, rather than a signpost for future returns.

Apple Pay (Back)

Most notably last week, we saw Apple’s AAPL results. While the iPhone maker reported lackluster earnings broadly in line with Morningstar analyst William Kerwin’s expectations, investors reacted strongly to news of a $110 billion buyback program, raising the stock’s price by 5.98% on Friday.

Although the capital discipline implied by this move is welcome, it is also a reminder that large companies have limited opportunities to reinvest their profits to fuel future growth. Firms with fewer such opportunities tend to trade at cheaper valuations, as other “Magnificent Seven” stocks are discovering.

Fed Remains Paused

The Federal Reserve has also managed investor expectations, with its continued lack of movement on interest rates being calmly received by market participants. However, expectations of future declines remain strong, as last week’s economic data was slightly weaker than anticipated. Friday’s US employment report showed an unexpected increase in unemployment to 3.9% from 3.8% the previous month. The market’s positive response to this news reflects a strong jobs market’s impact on inflation.

As the San Francisco Federal Reserve notes, core services are currently the main source of inflation. As employment costs typically represent the bulk of the cost of services, weakening employment growth may reduce inflation pressure and provide more opportunities to cut interest rates.

A Good Time to Go Fishing

With limited economic data this week, investors will likely pay close attention to comments from various Fed leaders, seeking confirmation of a slowing economy and lower future interest rates. While this represents a benign investing environment, this outlook already appears to be reflected in large US equities, priced near their fair value according to Morningstar analysts.

However, as Morningstar’s chief US market strategist David Sekera notes, there are attractively valued investment opportunities in other parts of the US market. Diversification always feels least attractive when prices are rising in our core investing area and markets are calm, but that is typically the best time to ensure portfolios are robust, whatever the future holds. Zachary Evens goes deeper into where else Morningstar analysts are finding value.

Highlights of This Week’s Market and Investing Events

- Monday, May 6: Earnings from Palantir Technologies PLTR

- Tuesday, May 7: Earnings from Walt Disney DIS

- Wednesday, May 8: Earnings from Uber Technologies UBER

- Thursday, May 9: Earnings from Roblox RBLX, Groupon GRPN

Stats for the Trading Week Ended May 3

- The Morningstar US Market Index rose 0.58%.

- The best-performing sectors were utilities, up 3.52%, and real estate, up 1.49%.

- The worst-performing sector was energy, down 3.38%

- Yields on 10-year US Treasury notes fell to 4.50% from 4.62%.

- West Texas Intermediate crude prices fell 8.50% to $78.12 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 380, or 54%, were up, one was unchanged, and 322, or 46%, were down.

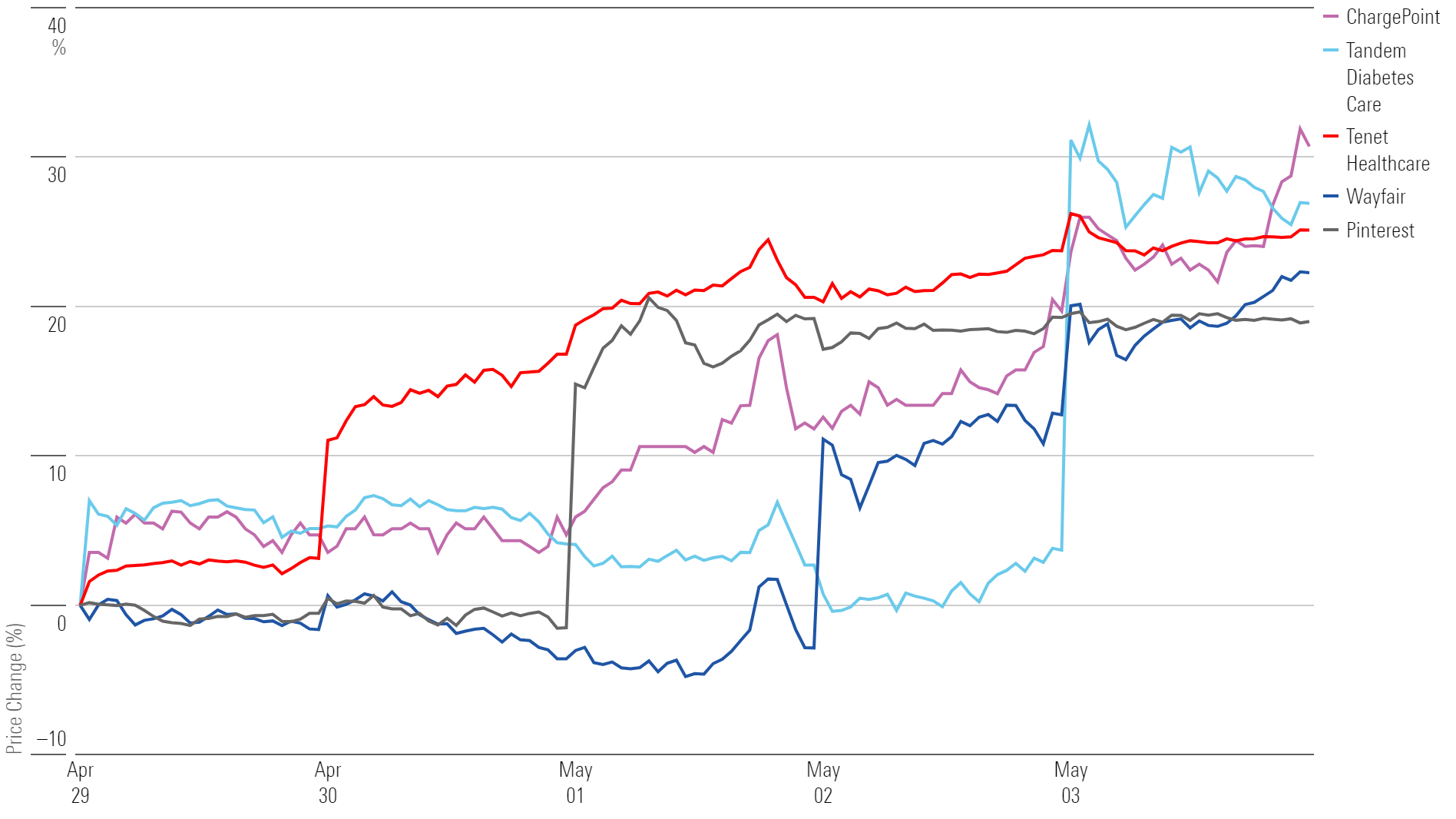

What Stocks Were Up?

ChargePoint CHPT, Tandem Diabetes Care TNDM, Tenet Healthcare THC, Wayfair W, and Pinterest PINS.

Best-Performing Stocks of the Week

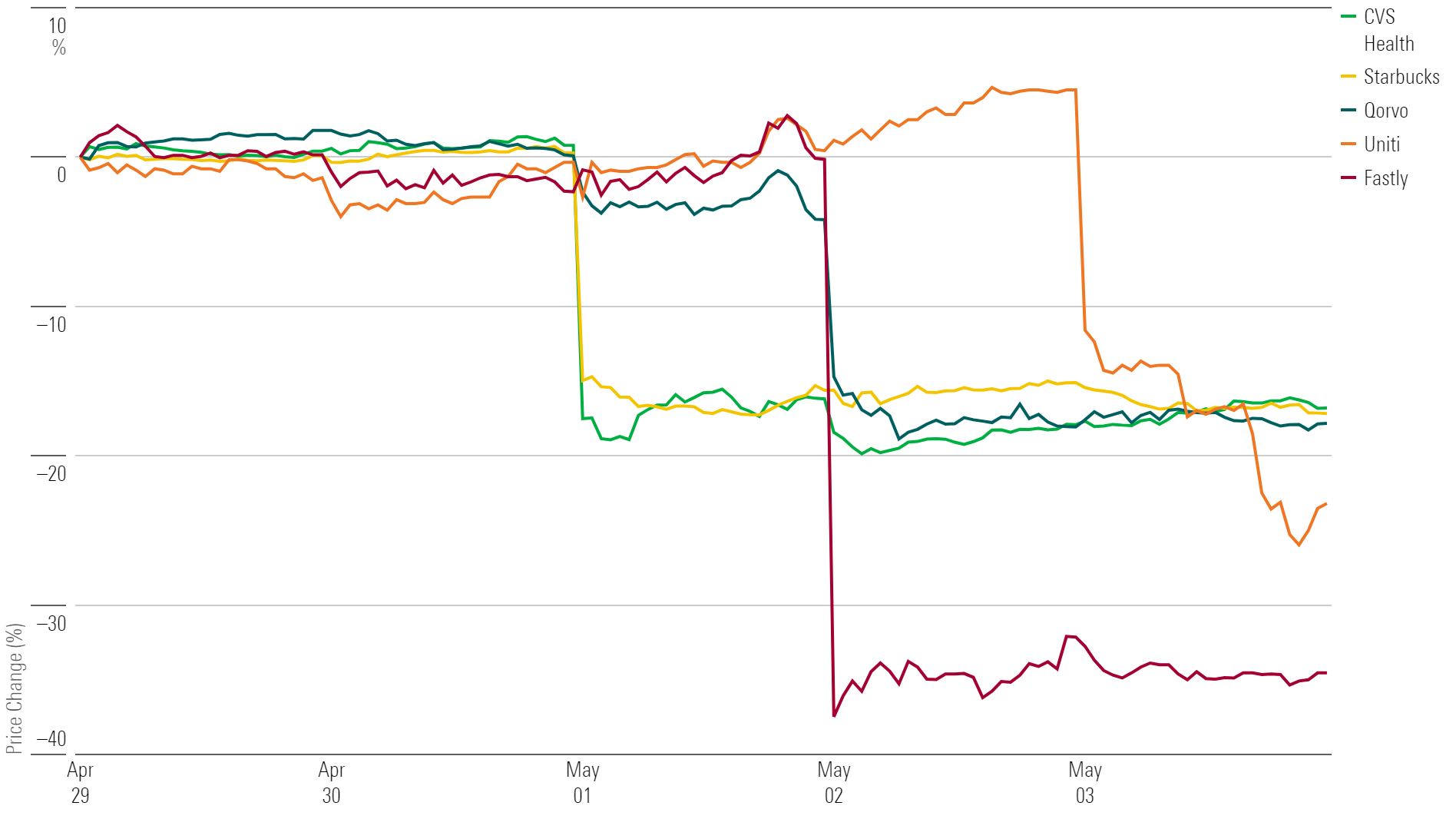

What Stocks Were Down?

Fastly FSLY, Uniti Group UNIT, Qorvo QRVO, Starbucks SBUX, and CVS Health CVS.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)